I would like to take the time to thank every single active and retired member of our country’s armed forces.

Thank You!

The average age of the military man is 19 years.

He is a short haired, tight-muscled kid who,

under normal circumstances is considered by

society as half man, half boy. Not yet dry behind

the ears, not old enough to buy a beer, but old

enough to die for his country. He never really

cared much for work and he would rather wax

his own car than wash his father’s, but he has

never collected unemployment either.

He’s a recent High School graduate; he was probably an average student, pursued some form of sp ort

activities, drives a ten year old jalopy, and has a

steady girlfriend that either broke up with him when

he left, or swears to be waiting when he returns from half a world away. He listens to rock and roll or hip-hop or rap or jazz or swing and a 155mm howitzer.

He is 10 or 15 pounds lighter now than when he

was at home because he is working or fighting

from before dawn to well after dusk. He has

trouble spelling, thus letter writing is a pain for him,

but he can field strip a rifle in 30 seconds and

reassemble it in less time in the dark. He can recite

to you the nomenclature of a machine gun or grenade launcher and use either one effectively if he must.

He digs foxholes and latrines and can apply first aid like a professional.

He can march until he is told to stop,

or stop until he is told to march.

He obeys orders instantly and without hesitation,

but he is not without spirit or individual dignity.

He is self-sufficient.

He has two sets of fatigues: he washes one and wears the other. He keeps his canteens full and his feet dry.

He sometimes forgets to brush his teeth, but never

to clean his rifle. He can cook his own meals, mend

his own clothes, and fix his own hurts.

If you’re thirsty, he’ll share his water with you; if you

are hungry, his food. He’ll even split his ammunition

with you in t he midst of battle when you run low.

He has learned to use his hands like weapons

and weapons like they were his hands.

He can save your life – or take it, because that is his job.

He will often do twice the work of a civilian, draw half the pay, and still find ironic humor in it all.

He has seen more suffering and death than he should have in his short lifetime.

He has wept in public and in private, for friends who have fallen in combat and is unashamed..

He feels every note of the National Anthem vibrate through his body while at rigid attention, while tempering the burning desire to ‘square-away ‘ those around him who haven’t bothered to stand, remove their hat, or even stop talking.

In an odd twist, day in and day out, far from home, he defends their right to be disrespectful.

Just as did his Father, Grandfather, and Great-grandfather, he is paying the price for our freedom. Beardless or not, he is not a boy. He is the American Fighting Man that has kept this country free for over 200 years.

He has asked nothing in return, except

our friendship and understanding.

Remember him, always, for he has earned our respect and admiration with his blood.

And now we even have women over there in danger, doing their part in this tradition of going to War when our nation calls us to do so.

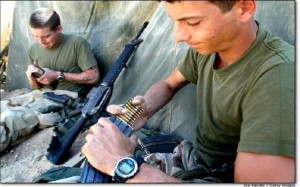

As you go to bed tonight, remember this shot. . .

A short lull, a little shade and a picture of

loved ones in their helmets.

Prayer wheel for our military… please don’t

break it Please send this on after a short prayer.

Prayer Wheel

‘Lord, hold our troops in your loving hands.

Protect them as they protect us.

Bless them and their families for the selfless acts they perform for us in our time of need. Amen.’

When you receive this, please stop for a moment and say a prayer for our ground troops in Afghanistan , sailors on ships, and airmen in the air, and for those in Iraq , Afghanistan and all foreign countries.

Of all the gifts you could give a US Soldier, Sailor, Coastguardsman, Marine, or Airman, prayer is the very best one.